Table of Contents

Effective portfolio risk management is crucial for safeguarding investments and maintaining a balanced risk profile within a portfolio. Organizations striving to enhance their portfolio management practices can initiate portfolio risk management once they have implemented effective work intake and prioritization processes.

The recent COVID-19 crisis, which significantly affected various companies and industries, underscores the importance of establishing robust project portfolio risk management procedures to protect the portfolio’s value. This article aims to offer a comprehensive overview of portfolio risk management.

What is Portfolio Risk Management?

Portfolio Risk Management is a strategic approach employed by organizations to assess, mitigate, and control potential risks associated with their investment portfolios. It involves the systematic identification, analysis, and prioritization of risks that may impact the performance or value of a portfolio. The primary goal is to implement measures that protect investments and maintain a balanced level of risk to ensure the overall health and resilience of the portfolio.

Managing Portfolio-Level Risks

Managing portfolio-level risks is a crucial component of effective portfolio management, involving a systematic approach to identifying, assessing, and mitigating potential threats that could impact the overall performance and success of a portfolio. Here’s a concise guide to managing risks at the portfolio level:

Risk Identification:

- Thorough Assessment: Conduct a comprehensive evaluation to identify a diverse range of risks that could affect the entire portfolio, considering financial, market, operational, and external factors.

- Stakeholder Involvement: Engage relevant stakeholders to gather insights and perspectives, ensuring a comprehensive understanding of potential risks.

Risk Analysis:

- Quantitative and Qualitative Assessment: Evaluate risks both quantitatively and qualitatively to gauge their potential impact and likelihood of occurrence.

- Scenario Analysis: Explore different scenarios to anticipate how risks may manifest and their potential impact on the portfolio.

Risk Prioritization:

- Criticality Ranking: Prioritize risks based on their potential impact on portfolio objectives and performance.

- Probability-Severity Matrix: Use a matrix to categorize and prioritize risks, focusing efforts on those with high impact and high probability.

Risk Mitigation Strategies:

- Diversification: Spread investments across various assets or projects to minimize concentration risk.

- Hedging: Employ financial instruments or strategies to offset potential losses in specific areas of the portfolio.

- Contingency Planning: Develop contingency plans and alternative strategies to address identified risks.

Monitoring and Control:

- Continuous Monitoring: Implement a robust monitoring system to track changes in risk factors and assess their impact on the portfolio.

- Adaptive Strategies: Be ready to adjust mitigation strategies as the portfolio evolves and market conditions change.

Communication and Reporting:

- Transparent Communication: Maintain open communication channels to keep stakeholders informed about potential risks and ongoing mitigation efforts.

- Regular Reporting: Provide regular updates on the status of portfolio-level risks, highlighting any changes and the effectiveness of mitigation measures.

Learning and Improvement:

- Post-Implementation Review: Conduct reviews after implementing mitigation strategies to assess their effectiveness and identify areas for improvement.

- Continuous Refinement: Use insights from past experiences to refine risk management processes, ensuring continuous improvement and resilience against future challenges.

By adopting a proactive and adaptive approach to managing portfolio-level risks, organizations can enhance their ability to navigate uncertainties and safeguard the overall health and performance of their portfolios.

Managing Portfolio Risk with Yoroproject's Project Portfolio Management Software

Managing portfolio risk is a critical aspect of effective project portfolio management, and Yoroproject provides a robust Project Portfolio Management (PPM) software solution to streamline this process. Here’s how Yoroproject can assist in managing portfolio risk:

Centralized Information Hub:

Yoroproject serves as a centralized platform, consolidating project-related data and providing a comprehensive view of the entire portfolio. This facilitates easy access to information necessary for risk assessment and management.

Risk Identification and Assessment:

The software allows for the systematic identification and assessment of risks associated with each project within the portfolio. Customizable fields and templates help in standardizing the risk management process.

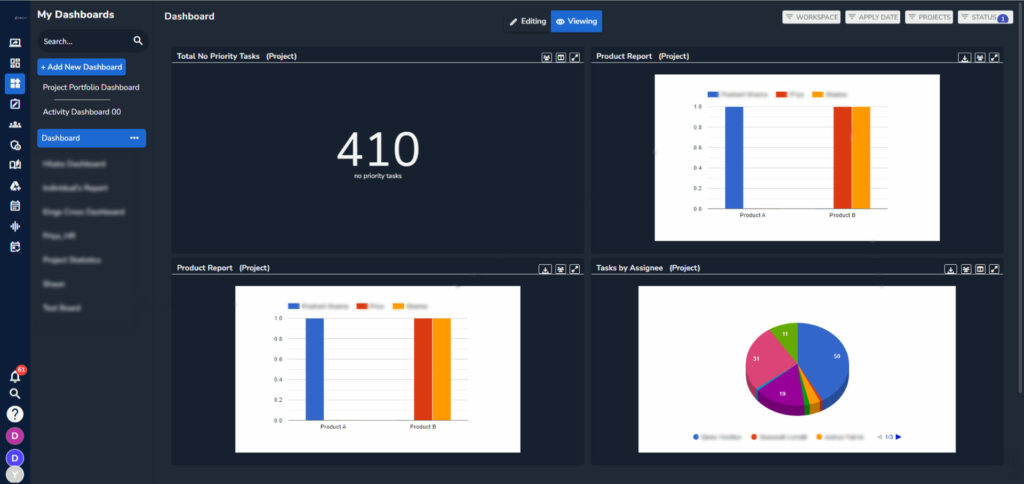

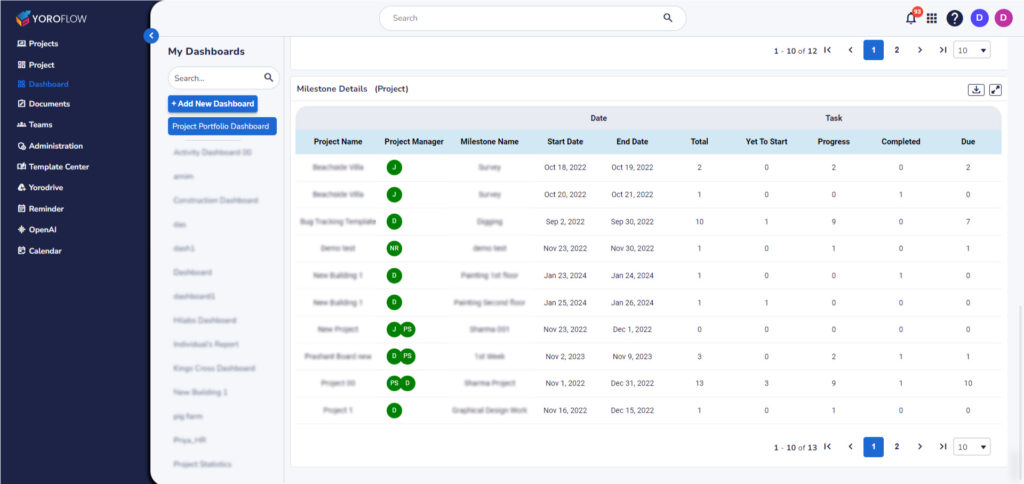

Portfolio-Level Reporting:

With built-in analytics and reporting features, Yoroproject allows users to generate portfolio-level reports. This makes it easier to analyze overall risk exposure, identify patterns, and make informed decisions to mitigate potential threats.

Customizable Workflows:

The software offers customizable workflows, allowing organizations to tailor risk management processes to their specific needs. This flexibility ensures that the software aligns with the unique risk management requirements of the portfolio.

Collaboration and Communication:

Yoroproject promotes collaboration and communication among team members. This is crucial for sharing insights, discussing risk mitigation strategies, and ensuring that everyone involved is aware of potential risks and their respective responsibilities.

Real-Time Tracking:

Yoroproject enables real-time tracking of project progress, project milestones, and potential risks. This ensures that project managers and stakeholders stay informed about any emerging risks and can take timely action.

Integration Capabilities:

Yoroproject can integrate with other tools and applications, enhancing its functionality. Integration with risk assessment tools, financial software, or communication platforms further strengthens the portfolio risk management process.

Document Management:

The software provides document management features, allowing users to store and organize relevant risk-related documents. This ensures that all supporting materials are easily accessible and contribute to a comprehensive risk management strategy.

Scalability:

Yoroproject is scalable and can accommodate portfolios of varying sizes. Whether managing a small set of projects or a large, complex portfolio, the software adapts to the organization’s needs.

Automation of Repetitive Tasks:

Yoroproject automates repetitive tasks, saving time and reducing the likelihood of human error. Automation ensures that risk management processes are consistently applied across the entire portfolio.

In summary, leveraging Yoroproject for project portfolio management provides a comprehensive solution for identifying, assessing, and managing risks at both the project and portfolio levels.

The software’s features contribute to efficient collaboration, real-time tracking, and informed decision-making, ultimately enhancing an organization’s ability to proactively manage and mitigate portfolio risks.